As filed with the Securities and Exchange Commission on March 18, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(A)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. ___)

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

Continental Building Products, Inc.

(Exact name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

o Fee paid previously with preliminary materials

| |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| 1) | Amount Previously Paid: |

| |

| 2) | Form, Schedule or Registration No.: |

CONTINENTAL BUILDING PRODUCTS, INC.

12950 Worldgate Drive, Suite 700

Herndon, Virginia 20170

April 1, 2016

March 18, 2019

To Our Stockholders:

You are cordially invited to attend the 20162019 Annual Meeting of Stockholders of Continental Building Products, Inc. The Annual Meeting will be held on Friday,Wednesday, May 6, 2016,1, 2019, at 9:008:30 a.m., local time, at our corporate headquarters located at 12950 Worldgate Drive, Suite 700, Herndon, Virginia 20170.

We describe in detail the actions we expect to take at our Annual Meeting in the attached Notice of 20162019 Annual Meeting of Stockholders and Proxy Statement.

In addition to the Proxy Statement you should have also received a copy of our Annual Report on Form 10-K for fiscal year 2015,2018, which we encourage you to read. It includes information about our operations as well as our audited, consolidated financial statements. You can also access a copy of our 20152018 Annual Report on Form 10-K on the Company’sCompany's website at www.continental-bp.com.

Please use this opportunity to take part in the affairs of our company by voting on the business to come before the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please complete, sign, date and return the accompanying proxy card or voting instruction card or vote electronically on the Internet or by telephone. See “About"About the Annual Meeting-How Dodo I Votevote by Proxy?”proxy?" in the Proxy Statement for more details. Returning the proxy card or voting instruction card or voting electronically on the Internet or by telephone does not deprive you of your right to attend the Annual Meeting and to vote your shares in person for the matters to be acted upon at the Annual Meeting.

We look forward to seeing you at the Annual Meeting.

Sincerely,

James Bachmann

President and Chief Executive Officer

CONTINENTAL BUILDING PRODUCTS, INC.

12950 Worldgate Drive, Suite 700

Herndon, Virginia 20170

_____________________

NOTICE OF 20162019 ANNUAL MEETING OF STOCKHOLDERS

_____________________

Important Notice Regarding the Availability of Proxy Materials for the Stockholder

Meeting to be Held on May 6, 20161, 2019

The Proxy Statement and accompanying Annual Report to Stockholders

are available at: http://materials.proxyvote.com/211171

|

| | |

| TIME AND DATE | 9:00 | 8:30 a.m., local time, on Friday,Wednesday, May 6, 20161, 2019 |

| | |

| LOCATION | | Continental Building Products, Inc. 12950 Worldgate Drive, Suite 700 Herndon, Virginia 20170 |

| | | |

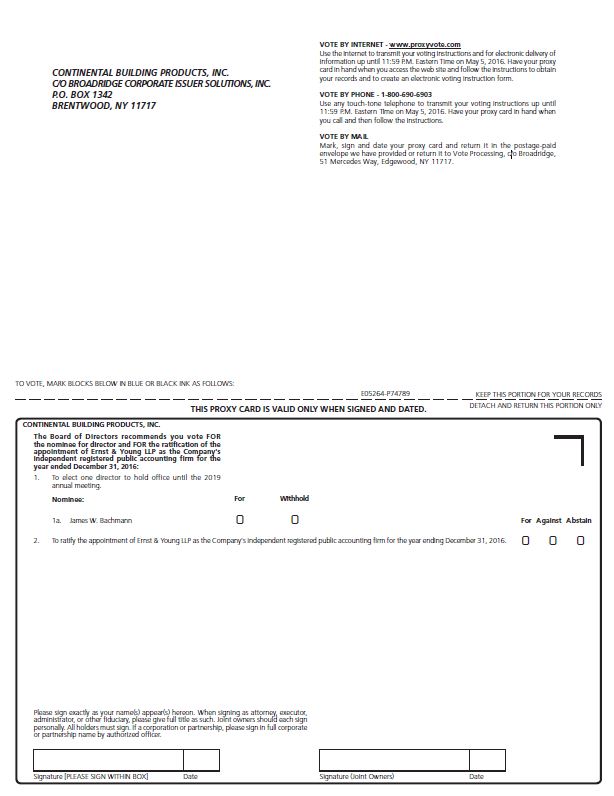

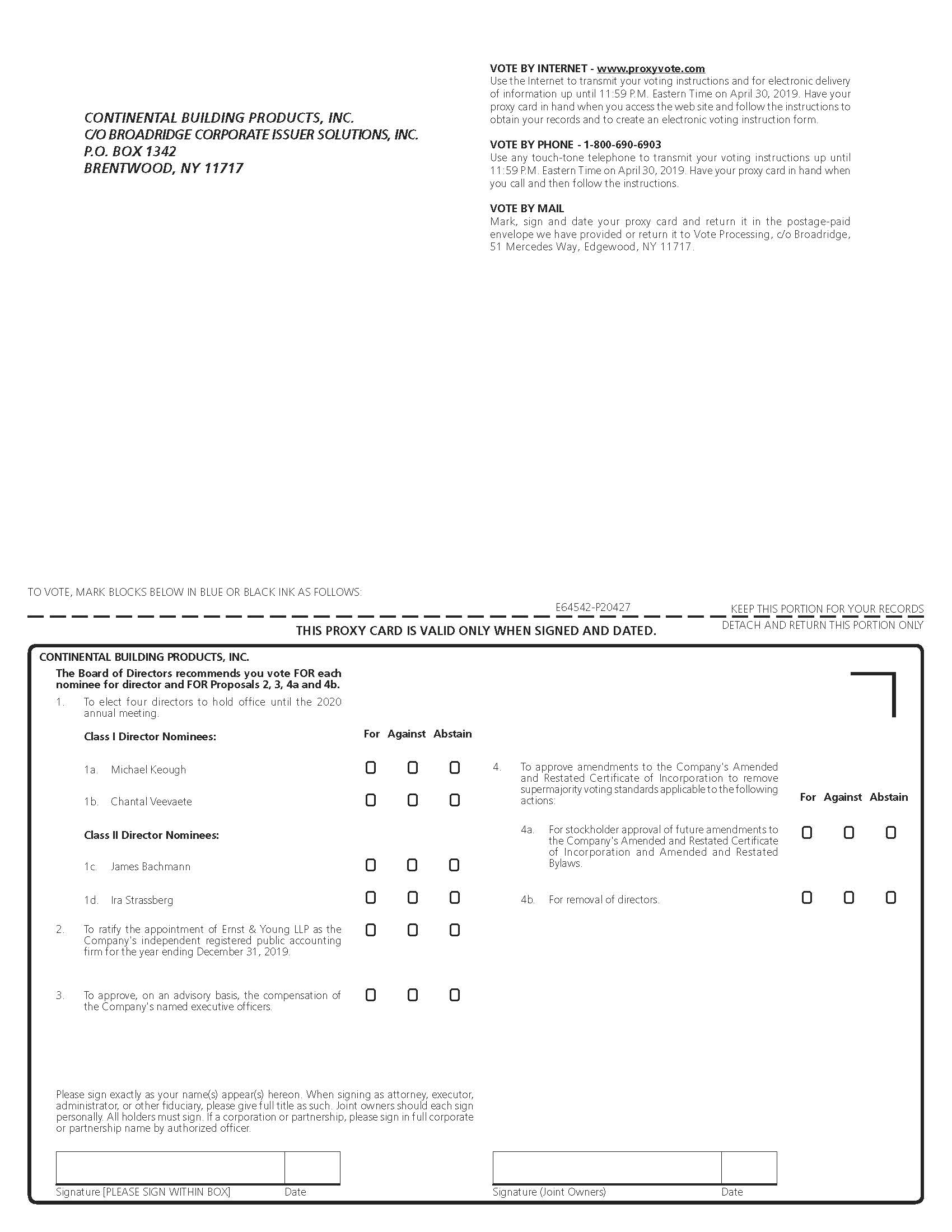

| ITEMS OF BUSINESS | 1.To1. | To elect the directorfour directors named in the Proxy Statement to hold office until the 20192020 annual meeting; and |

| | |

| | 2.To2. | To ratify the appointment of Ernst & Young LLP as the Company’sCompany's independent registered public accounting firm for the year ending December 31, 2016.2019; |

| | | |

| 3. | To approve, on an advisory basis, the compensation of the Company's named executive officers; and |

| 4. | To approve amendments to the Company's Amended and Restated Certificate of Incorporation to remove supermajority voting standards. |

| | |

| | Stockholders will also act upon such other matters as may properly come before the Annual Meeting. |

| | | |

| RECORD DATE | | The stockholders of record at the close of business on March 10, 2016,8, 2019 may attend and will be entitled to vote at the Annual Meeting and any adjournment or postponement thereof. |

| | | |

| PROXY VOTING | | It is important that your shares be represented and voted at the Annual Meeting. You can vote your shares by completing and returning the proxy card or voting instruction card sent to you. You also have the option of voting your shares electronically on the Internet or by telephone. Voting instructions are printed on your proxy card or voting instruction card. You can revoke your proxy at any time prior to its exercise at the Annual Meeting by following the instructions in the Proxy Statement. |

CONTINENTAL BUILDING PRODUCTS, INC.

12950 Worldgate Drive, Suite 700

Herndon, Virginia 20170PROXY STATEMENT

_____________________Table of Contents

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| PROXY STATEMENT SUMMARY | |

| This summary highlights information contained elsewhere in this Proxy Statement. This summary is not a complete description, and you should read this entire proxy statement before voting. | |

| | | | | | | | | | | | | | | |

| ANNUAL MEETING | |

| | | | | | | | | | | | | | | |

| Time and Date: | 8:30 a.m., local time, on Wednesday, May 1 2019 | |

| | | | | | | | | | | | | | | |

| Place: | Continental Building Products, Inc. | |

| | | 12950 Worldgate Drive, Suite 700, Herndon, Virginia 20170 | |

| | | | | | | | | | | | | | | |

| Record Date: | March 8, 2019 | |

| | | | | | | | | | | | | | | |

| Voting: | Stockholders on the record date are entitled to one vote per share on each matter to be voted upon at the annual meeting. | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| VOTING ITEMS AND BOARD RECOMMENDATIONS | |

| Item | | | | | | | | | Board Recommendation | | Page Reference | |

| | | | | | | | | | | | | | | |

| | | | For all nominees | | | |

| | | | | | | |

| | | | For | | | |

| | | | | | | | | | | | | | | |

| | | | For | | | |

| | | | | | | | | | | | | | | |

| | | | For | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| BOARD OF DIRECTORS | |

| | | | | | | | | | | | | | | |

| The following table provides summary information about each director nominee as of March 8, 2019. | |

| | | | | | | | | | Board Committees(1) | |

| Name | | Director Since | | Occupation and Experience | | Independent | | AC | | CC | | NCGC | |

| | | | | | | | | | | | | | |

| James Bachmann | | 2015 | | President and CEO of the Company with deep understanding of the Company's business and the industry | | No | | | | | | | |

| | | | | | | | | | | | | | |

| Michael Keough | | 2016 | | Retired Executive with significant experience as a President and Chief Executive Officer and in manufacturing/industry | | Yes | | Ÿ | | | | Ÿ | |

| | | | | | | | | | | | | | |

| Ira Strassberg | | 2017 | | Senior finance executive with deep knowledge of real estate finance and the multi-family housing sector | | Yes | | Ÿ | | | | | |

| | | | | | | | | | | | | | |

| Chantal Veevaete | | 2016 | | Retired Executive with extensive human resources, talent management and succession planning experience | | Yes | | | | Ÿ | | Ÿ | |

| | | | | | | | | | | | | | |

| (1) AC - Audit Committee; CC - Compensation Committee; NCGC - Nominating and Corporate Governance Committee | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| As a matter of good governance, we are asking our stockholders to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019. | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

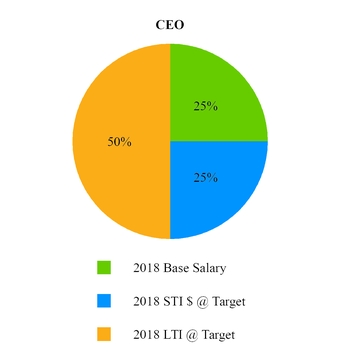

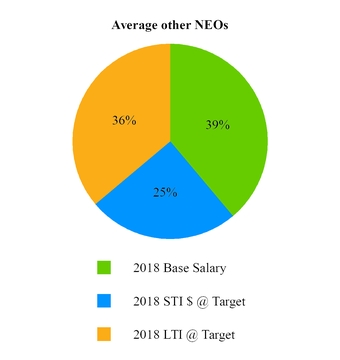

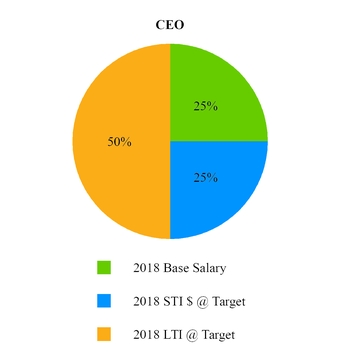

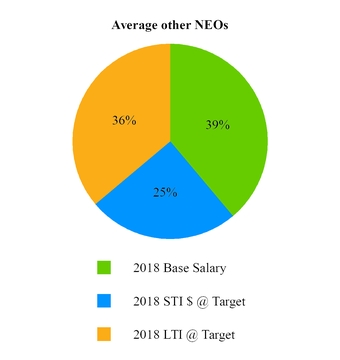

| EXECUTIVE COMPENSATION | |

| Our Board is asking that our stockholders vote to approve, on an advisory (non-binding) basis, the compensation of our named executive officers as disclosed in this proxy statement. The vote is not intended to address any specific item of our compensation program, but rather to address our overall approach to the compensation of our named executive officers. Please read "Compensation Discussion and Analysis." | |

| | |

| | |

| AMENDMENTS TO AMENDED AND RESTATED CERTIFICATE OF INCORPORATION | |

| We are asking stockholders to approve certain amendments to the Company's Amended and Restated Certificate of Incorporation, including in particular (1) removal of the supermajority voting standard for stockholder approval of amendments to the Company's Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws and (2) removal of the supermajority voting standard for removal of directors. | |

| | | | | | | | | | | | | | | |

ABOUT THE ANNUAL MEETING

We are providing these proxy materials in connection with the 20162019 Annual Meeting of Stockholders of Continental Building Products, Inc. This Proxy Statement, the accompanying proxy card or voting instruction card, and the Company’s 2015Company's 2018 Annual Report on Form 10-K were first mailed to stockholders on or about April 1, 2016March 18, 2019.This Proxy Statement contains important information for you to consider when deciding how to vote on the matters to be brought before the Annual Meeting. Please read it carefully. Unless the context otherwise indicates, references to “Continental"Continental Building Products,” “our" "our company,” “the" "the Company,” “us,” “we”" "us," "we" and “our”"our" refer to Continental Building Products, Inc. and its consolidated subsidiaries.

ABOUT THE ANNUAL MEETING

Who is soliciting my vote?

The Board of Directors of the Company is soliciting your vote in connection with the 20162019 Annual Meeting of Stockholders.

What is the purpose of the Annual Meeting?

The meeting will be the Company’s regular Annual Meeting of Stockholders. You will be voting on the following matters at the Annual Meeting:

| |

| 1. | Election of the directorfour directors named in the Proxy Statement to hold office until the 20192020 annual meeting; and |

| |

| 2. | Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2016.2019; |

| |

| 3. | Advisory vote to approve the compensation of the Company's named executive officers; and |

| |

| 4. | Amendment of the Company's Amended and Restated Certificate of Incorporation of the Company to remove supermajority voting standards. |

Stockholders will also act upon such other business that may properly come before the Annual Meeting.

How does the Board of Directors recommend I vote?

The Board of Directors recommends a vote:

| |

| 1. | For the election of James W. Bachmann, Michael Keough, Ira Strassberg and Chantal Veevaete, as a director; anddirectors to hold office until the 2020 annual meeting; |

| |

| 2. | For the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2016.2019; |

| |

| 3. | For the approval, on an advisory basis, of the compensation of the Company's named executive officers; and |

| |

| 4. | For the approval of the proposed amendments to the Company's Amended and Restated Certificate of Incorporation of the Company identified in Proposals 4(a) and 4(b). |

Who is entitled to vote at the Annual Meeting?

The Board of Directors set March 10, 20168, 2019 as the record date for the Annual Meeting, or the Record Date. All stockholders who owned common stock of the Company at the close of business on the Record Date may attend and vote at the Annual Meeting.

Who is entitled to attend the Annual Meeting?

Only persons with evidence of stock ownership as of the Record Date or who are invited guests of the Company may attend and be admitted to the Annual Meeting. Stockholders with evidence of stock ownership as of the Record Date may be

accompanied by one guest. Photo identification will be required (e.g., a valid driver’sdriver's license, state identification or passport). If a stockholder’sstockholder's shares are registered in the name of a broker, trust, bank or other nominee, the stockholder must bring a proxy or a letter from that broker, trust, bank or other nominee or their most recent brokerage account statement that confirms that the stockholder was a beneficial owner of shares of stock of the Company as of the Record Date.

CamerasThe use of cameras (including cell phones with photographic capabilities), recording devices and other electronic devices will not be permitted at the Annual Meeting.

How many votes can be cast by stockholders?

Each share of common stock is entitled to one vote. There is no cumulative voting. There were 41,635,84835,254,482 shares of common stock outstanding and entitled to vote on the Record Date.

How many votes must be present to hold the Annual Meeting?

A majority of the outstanding shares of common stock as of the Record Date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This is called a “quorum.”"quorum." Your shares are counted as present at the Annual Meeting if you are present at the Annual Meeting and vote in person or a proxy card or voting instruction card has been properly submitted by you or on your behalf or you have voted electronically on the Internet or by telephone. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. A “broker non-vote”"broker non-vote" is a share of common stock that is beneficially owned by a person or entity and held by a broker or other nominee, but for which the broker or other nominee (1) lacks the discretionary authority to vote on certain matters and (2) has not received voting instructions from the beneficial owner in respect of those specific matters.

How many votes are required to elect directors and approve the other proposals?

Directors are elected byunder a pluralitymajority voting standard in uncontested director elections (i.e. an election where the number of candidates does not exceed the votes cast. This meansnumber of directors to be elected). The election of directors at the Annual Meeting constitutes an uncontested director election. Under a majority voting standard in uncontested director elections, the number of shares voted "for" a nominee's election must exceed the number voted "against" that the individual nominated for election to the Board of Directors who receives the most “FOR” votes (among votes properly cast in person or by proxy) will be elected.nominee's election. Abstentions and broker non-votes are not counted for purposes of the election of directors and, therefore, will not affect the outcome of the election of directors.

ToIn respect of proposals 2 and 3, to be approved, the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm requireseach such proposal must receive the affirmative vote of a majority of the shares of common stock present, in person or by proxy, at the Annual Meeting and entitled to vote.vote on the proposal. Abstentions have the same effect as a vote against either such proposal. Broker non-votes will not affect the outcome of either such proposal, although brokers do have discretionary authority to vote on the ratification of the appointment of Ernst & Young LLP.

The results of the advisory vote on the compensation of the Company's named executive officers are not binding on the Board of Directors.

In respect of proposals 4(a) and 4(b), to be approved, each such proposal must receive the affirmative vote of no less than 66 2/3% of the number of shares of common stock outstanding and entitled to vote on the proposals. Abstentions and broker non-votes have the same effect as a vote against either such proposal.

Lone Star Fund VIII (U.S.), L.P., which we refer to in this Proxy Statement, along with its affiliates and associates (excluding us and other companies that it or they own as a result of their investment activities), as Lone Star, held approximately 14.4% of the Company’s common stock as of the Record Date through LSF8 Gypsum Holdings, L.P. Lone Star has indicated that it willHow do I vote its shares in favor of the director nominee named in this Proxy Statement and in favor of Proposal 2. If Lone Star votes as it has indicated, its vote is sufficient to meaningfully impact the election of the nominee and the adoption of Proposal 2. Following the Record Date on March 18, 2016, Lone Star sold all of its shares of the Company’s common stock.

How Do I Vote by Proxy?proxy?

You can vote your shares by completing and returning the proxy card or voting instruction card accompanying this Proxy Statement. You also have the option of voting your shares electronically on the Internet or by telephone. Your Internet or telephone vote authorizes the named proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card or voting instruction card. Please see your proxy card or voting instruction card for more information on how to vote by proxy.

What if I don’t vote for some of the items listed on my proxy card or voting instruction card?

If you are a stockholder of record and you return your signed proxy card or voting instruction card in the enclosed envelope but do not mark selections, it will be voted in accordance with the recommendations of the Board of Directors. Similarly, if you vote electronically on the Internet or by telephone and do not vote on all matters, your shares will be voted in accordance with the recommendations of the Board of Directors for the matters on which you do not vote. In connection therewith, the Board of Directors has designated James Bachmann and Timothy Power as proxies. If you indicate a choice with respect to any matter to be acted upon on your proxy card or voting instruction card, your shares will be voted in accordance with your instructions. Similarly, if

you vote electronically on the Internet or by telephone and vote on any matter, your shares will be voted in accordance with your instruction.instructions. If any other matter properly comes before the Annual Meeting, the shares will be voted in the discretion of the persons voting pursuant to the respective proxies.

If you are a beneficial owner and hold your shares in street name through a broker or other nominee and do not return the voting instruction card, the broker or other nominee will vote your shares on each matter at the Annual Meeting for which he or she has the requisite discretionary authority. Under applicable rules, brokers have the discretion to vote on routine matters, such as the ratification of the appointment of independent registered public accounting firms. However, brokers do not have the discretion to vote on the election of directors.directors or the other matters that will come before the Annual Meeting.

Who pays for the proxy solicitation and how will the Company solicit votes?

The Company bears the expense of printing and mailing proxy materials. In addition to this solicitation of proxies by mail, the Company’sCompany's directors, officers and other employees may solicit proxies by personal interview, telephone, facsimile or email. These individuals will not be paid any additional compensation for any such solicitation. The Company will request brokers and other nominees who hold shares of common stock in their names to furnish proxy materials to the beneficial owners of such shares. The Company will reimburse such brokers and other nominees for their reasonable expenses incurred in forwarding solicitation materials to such beneficial owners.

Can I change or revoke my vote after I return my proxy card or voting instruction card?

Yes. Even if you sign and return the proxy card or voting instruction card in the form accompanying this Proxy Statement or you vote electronically over the Internet or by telephone, you retain the power to revoke your proxy or change your vote. You can revoke your proxy or change your vote at any time before it is exercised at the Annual Meeting by giving written notice to the Secretary of the Company, specifying such revocation. You may also change your vote by timely delivering a valid, later-dated proxy or voting instruction card, a later-dated electronic vote over the Internet or by telephone or by voting in person at the Annual Meeting. However, please note that if you would like to vote at the Annual Meeting and you are not the stockholder of record, you must request, complete and deliver a proxy from your broker or other nominee.

PROPOSAL NO. 1 - ELECTION OF DIRECTOR

DIRECTORS

At the Annual Meeting, stockholders will be asked to elect one directorfour directors to serve on the Board of Directors. The Company’sCompany's Amended and Restated Certificate of Incorporation provides that the Board of Directors shall consist of not fewer than three nor more than 15 directors with the exact number to be determined from time to time by resolution adopted by resolution of the Board of Directors. The Board currently consists of sixseven directors. The Company’sCompany's Amended and Restated Certificate of Incorporation currently divides the Board of Directors into three classes with the terms of office of the directors of each Class ending in different years.based on class. The terms of directors in Classes I and II IIIpresently end at the Annual Meeting, and Ithe terms of directors in Class III presently end at the annual meetingsmeeting in 2016, 2017 and 2018, respectively.2020. Class I currently has two directors, Class II currently has one directortwo directors and Class III currently has three directors. Prior to the Company's 2018 annual meeting, directors were elected for three year terms. However, beginning with the 2018 annual meeting, by the terms of the Company's Amended and Restated Certificate of Incorporation, directors are elected to serve for one year terms, with the full board being elected annually beginning with the 2020 annual meeting of stockholders, eliminating the classified board.

The Board of Directors has nominated James W. BachmannMichael J. Keough and Chantal D. Veevaete for election as a Class II director for a three-year termI directors to serve one-year terms expiring at the 20192020 annual meeting, and James Bachmann and Ira Strassberg as Class II directors to serve one-year terms expiring at the 2020 annual meeting. When elected, a director serves until his or her successor has been duly elected and qualified or until any such director’sdirector's earlier resignation or removal. Please see “The"The Board of Directors and Its Committees”Committees" below for information about the nominees for election as directors and the current members of the Board of Directors who will continue serving following the Annual Meeting, their business experience and other pertinent information.

Proxies cannot be voted for a greater number of persons than the number of nominees named. If you sign and return the accompanying proxy card or voting instruction card or vote electronically over the Internet or by telephone, your shares will be voted for the election of the nominee recommended by the Board of Directors unless you choose to abstain or vote against the nominee. If theany nominee for any reason is unable to serve or will not serve, proxies may be voted for such substitute nominee or nominees as the proxy holderholders may determine.determine or just for the remaining nominees, leaving a vacancy. Alternatively, the Board of Directors may reduce its size. The Company is not aware that any of the nomineenominees will be unable to or will not serve as a director. The Company did not receive any stockholder nominations for director for the Annual MeetingMeeting.

Directors are elected by a pluralitymajority of the votes cast. This means that the individual nominated for election tonumber of shares voted "for" a director must exceed the Board of Directors who receives the most “FOR” votes (among votes properly cast in person or by proxy) will be elected.number voted "against" that director. Abstentions and broker non-votes will not affect the outcome of the election of directors.

Pursuant to the Company's Principles of Corporate Governance, any nominee for director in an uncontested election who is not elected by a majority of the votes cast is expected to tender his or her resignation to the Nominating and Corporate Governance Committee of the Board of Directors. The Nominating and Corporate Governance Committee will recommend to the Board of Directors whether to accept the resignation offer or whether other action should be taken, and the Board of Directors will then make its decision. In determining what action to recommend and whether to accept the resignation, the Nominating and Corporate Governance Committee and the Board of Directors, as applicable, will consider all factors they consider to be relevant. See "Corporate Governance - Majority Voting for Directors."

The Board of Directors unanimously recommends that you vote FOR all Nominees.

|

|

The Board of Directors unanimously recommends that you vote FOR the Nominee.

|

PROPOSAL NO. 2 - RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP

The Audit Committee has selected Ernst & Young LLP to audit the consolidated financial statements of the Company as of December 31, 2016,2019, and for the fiscal year then ending. At the Annual Meeting, stockholders will be asked to ratify the appointment of Ernst & Young.

The Company has been advised by Ernst & Young that the firm has no relationship with the Company or its subsidiaries other than that arising from the firm’sfirm's engagement as auditors, tax advisorsadvisers and consultants.The Company has also been advised that representatives of Ernst & Young will be present at the Annual Meeting where they will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither the Company’sCompany's Amended and Restated Certificate of Incorporation nor the Company’s bylawsCompany's Bylaws require that stockholders ratify the appointment of Ernst & Young as the Company’sCompany's independent registered public accounting firm. However, we are requesting ratification because we believe it is a matter of good corporate practice. If the Company’sCompany's stockholders do not ratify the appointment, the Audit Committee will reconsider whether or not to retain Ernst & Young, but may, nonetheless, retain Ernst & Young as the Company’sCompany's independent registered public accounting firm. Even if the appointment is ratified, the Audit Committee in its discretion may change the appointment at any time if it determines that the change would be in the best interests of the Company and its stockholders.

The affirmative vote of a majority of the shares of common stock present, in person or by proxy, at the Annual Meeting is necessary to ratify the appointment of Ernst & Young as the Company’sCompany's independent registered public accounting firm for the year ending December 31, 2016.2019. Abstentions have the same effect as a vote against the proposal.

The Board of Directors unanimously recommends that you vote FOR the ratification of the appointment of Ernst & Young as the Company's independent registered public accounting firm for the year ending December 31, 2019.

PROPOSAL NO. 3 - ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

In accordance with the Dodd-Frank Act and related rules of the Securities and Exchange Commission, which we refer to as the SEC, we are providing stockholders an advisory vote on the compensation of our named executive officers. The advisory vote is a non-binding vote on the compensation of our named executive officers as described in this proxy statement in the Compensation Discussion and Analysis section, the tabular disclosure regarding such compensation and the Company's accompanying narrative disclosure. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement.

In connection with this proposal, you are encouraged to carefully review the Compensation Discussion and Analysis section as well as the information contained in the executive compensation tables and accompanying narrative discussion contained in this proxy statement. The Compensation Committee of the Board of Directors believes our executive compensation program is reasonable and aligned with stockholder interests.

The vote on our executive compensation programs is advisory and non-binding on the Company. However, the Compensation Committee, which is responsible for designing and administering the Company's executive compensation programs, will consider the outcome of the vote when making future compensation decisions regarding our named executive officers.

Our stockholders are being asked to approve by advisory vote the following resolution relating to the compensation of the named executive officers in this proxy statement:

"RESOLVED, that Continental Building Products, Inc.'s stockholders hereby approve the compensation paid to the company's executive officers named in the Summary Compensation Table of this Proxy Statement, as that compensation is disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, the various compensation tables and the accompanying narrative discussion included in this proxy statement."

The Board of Directors unanimously recommends that you vote FOR the approval, on an advisory basis, of the compensation of the Company's named executive officers.

PROPOSAL NO. 4 - APPROVAL OF AMENDMENTS TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO REMOVE SUPERMAJORITY VOTING STANDARDS

After careful consideration and upon the recommendation of the Nominating and Corporate Governance Committee, the Board voted to approve, and to recommend to our stockholders that they approve, amendments to our Amended and Restated Certificate of Incorporation (the "Certificate") to remove the supermajority voting standards currently in the Certificate and provide for majority voting standards, and to adopt certain other immaterial amendments to the Certificate, each as described below (collectively, the "Proposed Certificate Amendments"). The Proposed Certificate Amendments are set forth in Proposal No. 4(a) and Proposal No. 4(b) below. The vote required to approve each of the Proposed Certificate Amendments is discussed below. Approval of either Proposal is not conditioned upon approval of the other Proposal.

Our Certificate currently contains the following supermajority voting provisions:

Future Amendments to the Certificate and Bylaws. The Certificate states that a supermajority vote is necessary for stockholders to adopt, amend or repeal any provision of the Certificate or the Amended and Restated Bylaws (as amended, the "Bylaws"). Proposal No. 4(a) proposes to amend the Certificate so that future stockholder-approved amendments to the Certificate or the Bylaws require approval of a majority of the voting power of the stock outstanding and entitled to vote thereon.

|

|

The Board of Directors unanimously recommends that youRemoval of Directors. The Certificate states that a supermajority vote is necessary for stockholders to remove directors. Proposal No. 4(b) proposes to amend the Certificate so that the removal of a director or the entire Board will be governed by the applicable threshold under the Delaware General Corporation Law, which is a majority vote standard.FOR the ratification of the appointment of Ernst & Young as the Company’s independent registered public accounting firm for the year ending December 31, 2016. |

In addition, the Proposed Certificate Amendments include certain immaterial changes that are described below.

Reasons for the Proposed Certificate Amendments

As a part of our ongoing review of our corporate governance, the Board determined that it is in the best interests of the Company and our stockholders to remove the supermajority voting standards in our Certificate and provide for majority voting standards.

The Board recognizes that supermajority voting standards are intended to protect against self-interested action by large stockholders by requiring broad stockholder support for certain types of governance changes or corporate actions. The Board also recognizes that many investors and others have begun to view supermajority voting provisions as conflicting with principles of good corporate governance. For example, some stockholders and commentators argue that supermajority voting standards should be eliminated due to a perception that they could limit a board’s accountability to stockholders or stockholder participation in a company’s corporate governance by allowing the holders of a minority of shares to block action deemed desirable by the holders of a majority of the shares. In addition, in the course of our regular discussions with our stockholders, a number of stockholders indicated to Company representatives that they supported the removal of the supermajority provisions. It is important to note that if the Proposed Certificate Amendments are approved, they could make it easier for stockholders to effect other corporate governance changes in the future.

After considering the advantages and disadvantages of maintaining supermajority voting standards in the Certificate, and upon the recommendation of the Nominating and Corporate Governance Committee, the Board adopted resolutions setting forth the Proposed Certificate Amendments, declaring the Proposed Certificate Amendments advisable, and resolving to submit them to the Company’s stockholders for consideration with the recommendation that stockholders approve the Proposed Amendments.

The Proposed Certificate Amendments

Proposal No. 4(a): Removal of Supermajority Voting Standards for Stockholder Approval of Future Amendments to the Certificate and Bylaws

Description of Amendment. Currently, Section 9.1 of Article IX of the Certificate states that in order for stockholders to adopt, amend or repeal any provision of the Certificate, that action must be approved by the affirmative vote of at least 66 2/3% of the voting power of the stock outstanding and entitled to vote thereon, voting together as a single class. Section 9.2 of Article IX states that in order for stockholders to adopt, amend or repeal any provision of the Bylaws, that action must be approved by the affirmative vote of at least 66 2/3% of the voting power of the stock outstanding and entitled to vote thereon, voting together as a single class.

This Proposal 4(a) requests that stockholders approve amendments to the Certificate that replace the references to "66 2/3%" in Sections 9.1 and 9.2 of Article IX with a "majority." As a result, any future action by stockholders to adopt, amend or repeal any provision of the Certificate or Bylaws, as amended, would require approval by the affirmative vote of at least a majority of the voting power of the stock outstanding and entitled to vote thereon, voting together as a single class.

In addition, the Board has approved a conforming amendment to Section 9.1 of the Bylaws, which, like the Certificate, currently provides that stockholders can adopt, amend or repeal any provision of the Bylaws only if that action is approved by the affirmative vote of at least 66 2/3% of the voting power of the stock outstanding and entitled to vote thereon, voting together as a single class. The Bylaw amendment would replace this supermajority voting provision with the same majority voting standard proposed for Section 9.2 of Article IX of the Certificate, but will become effective only if stockholders approve the Proposed Certificate Amendments set forth in this Proposal 4(a).

Vote Required to Approve. Under the existing supermajority provision in the Certificate, the affirmative vote of at least 66 2/3% of the voting power of the stock outstanding and entitled to vote thereon is required to approve this Proposal 4(a).

Proposal No. 4(b): Removal of Supermajority Voting Standard for Removal of Directors

Description of Amendment. Currently, Section 5.2(c) of Article V of the Certificate states that any director or the entire Board may be removed from office, only for cause, upon the affirmative vote of at least 66 2/3% of the voting power of the stock outstanding and entitled to vote thereon.

This Proposal 4(b) requests that stockholders approve an amendment to the Certificate that removes this supermajority voting provision. The amendment also deletes the remainder of Section 5.2(c), which includes a legacy provision relating to the director removal rights of the Company’s former controlling stockholder, the Lone Star Entities (as defined in the Certificate). With the deletion of Section 5.2(c) of the Certificate, the removal of directors by stockholders will be governed by the default provision under the Delaware General Corporation Law, which requires the vote of a majority of the shares then entitled to vote at an election of directors and provides for removal with or without cause where a board of directors is not classified. By the terms of the Company’s Certificate, the full Board will be elected annually beginning with the 2020 Annual Meeting of Stockholders, eliminating the classified board.

Proposal 4(b) also includes additional immaterial changes that remove other legacy provisions relating to the Lone Star Entities that are no longer applicable (collectively, the "Legacy Provisions"). In addition to the language of Section 5.2(c) described above, the Legacy Provisions address the Lone Star Entities’ ability to fill vacancies on the Board (Section 5.2(b)) and to act by written consent (Article VI), as well as other provisions regarding fiduciary duties (Section 10.2) and corporate opportunities (Article XI) specific to representatives of the Lone Star Entities while they served on the Board, and the effective time of the Certificate (Article XIII). The Lone Star Entities do not (to the Company’s knowledge) beneficially own any shares of the Company’s common stock, and the Lone Star Entities do have any representatives serving on the Board.

In addition, the Board has approved a conforming amendment to Section 3.4(b) of Article III of the Bylaws, which, like the Certificate, currently requires a 66 2/3% vote for stockholders to remove directors. This Bylaw amendment will become effective only if stockholders approve the Proposed Certificate Amendments set forth in this Proposal 4(b).

Vote Required to Approve. Under the existing supermajority provision in the Certificate, the affirmative vote of at least 66 2/3% of the voting power of the stock outstanding and entitled to vote thereon is required to approve this Proposal 4(b).

Additional Information

The full text of the Proposed Certificate Amendments, in each case marked to show the proposed deletions and insertions, is set forth in Appendix A to this Proxy Statement. Deletions are indicated by strike-out and insertions are indicated by underlining. The general description of provisions of our Certificate and the Proposed Certificate Amendments set forth herein are qualified in their entirety by reference to the text of Appendix A.

If the Proposed Certificate Amendments included in either or both of Proposals 4(a) and 4(b) are approved by our stockholders, the approved amendments will become effective upon the filing of an amended and restated certificate of incorporation with the Secretary of State of the State of Delaware, which is expected to occur after our 2019 Annual Meeting of Stockholders. However, if the Company’s stockholders approve the Proposed Certificate Amendments, the Board retains discretion under Delaware law not to implement the approved amendments. If the Board exercises this discretion, it will publicly disclose that fact and the reason for its determination. As noted above, the Board has also approved conforming amendments to the Bylaws, contingent upon stockholder approval and implementation of the Proposed Certificate Amendments. If the Proposed Certificate Amendments included in either or both of Proposals 4(a) and 4(b) are not approved by stockholders, the Proposed Certificate Amendments that are not approved by stockholders will not be implemented and the Company’s current voting standards relating to the Proposed Certificate Amendments that were not approved will remain in place and the conforming amendments to the Bylaws will not become effective.

The Board of Directors unanimously recommends that you vote FOR the amendment of the Amended and Restated Certificate of Incorporation to Approve the Proposed Certificate Amendments.

THE BOARD OF DIRECTORS AND ITS COMMITTEES

The Board of Directors believes the Board, as a whole, should possess the requisite combination of skills, professional experience, and diversity of backgrounds to oversee the Company’sCompany's business. The Board of Directors also believes there are certain attributes each individual director should possess, as reflected in the Board of Directors’Directors' membership criteria. Accordingly, the Board of Directors and the Nominating and Corporate Governance Committee consider the qualifications of directors and director candidates individually as well as in the broader context of the Board’sBoard's overall composition and the Company’sCompany's current and future needs.

The qualifications that the Nominating and Corporate Governance Committee and Board of Directors consider in identifying qualified candidates to serve as directors include age, skills, such as financial background and acumen, education, professional and academic affiliations, industries served, length of service, positions held, and geographies served. The Nominating and Corporate Governance Committee also considers diversity of viewpoints, backgrounds, experience and other demographics in evaluating director candidates and how they would contribute to the overall composition of the Board. The Nominating and Corporate Governance Committee assesses the effectiveness of its efforts at pursuing diversity across these measures as part of evaluating the composition of the Board. The Nominating and Corporate Governance Committee may also consult with outside advisers or retain search firms to assist in the search for qualified candidates. Once potential candidates are identified, including those candidates nominated by stockholders, the Nominating and Corporate Governance Committee reviews the backgrounds of those candidates. Final candidates are then chosen and interviewed by other Board or management representatives. Based on the interviews, the Nominating and Corporate Governance Committee then makes its recommendation to the Board of Directors. If the Board of Directors approves the recommendation, the candidate is nominated for election. For incumbent directors, the factors also include past performance on the Board of Directors and its committees. With regard to procedures for stockholder nominations of director candidates, please see the requirements described below under "Stockholder Proposals."

The Nominating and Corporate Governance Committee is responsible for periodically reviewing with the Board the appropriate skills and characteristics required of Board members in the context of the current make-up of the Board. This assessment enables the Board to update the skills and experience it seeks in the Board as a whole, and in individual directors, as the Company’sCompany's needs evolve. This assessment takes into consideration all factors deemed relevant by the Nominating and Corporate Governance Committee, including the matters described under “-Committees"Committees of the Board of Directors-Nominating and Corporate Governance Committee”Committee" below. For incumbent directors,

Our Board has established a tenure limitation by which no Board member may serve as a director for more than nine consecutive years and an age limitation by which no Board member may commence a term as director after attaining the factors also include past performance on the Boardage of Directors and its committees.72.

The following table sets forth the names, ages and background information of the nomineenominees for election as director and the current members of the Board of Directors who will continue serving following the Annual Meeting, as well as each individual’sindividual's specific experience, qualifications and skills that led the Board of Directors to conclude that each such nominee/director should serve on the Board of Directors. The personindividuals who hashave been nominated for election and isare to be voted upon at the Annual Meeting isare listed first, with continuing directors following thereafter.

NomineeNominees

|

| | |

| Michael Keough | Age 67 | Class I |

Mr. Keough has been a member of our Board of Directors since March 2016. From November 2012 through January 2016, Mr. Keough served as President and Chief Executive Officer of Stronghaven Inc., a manufacturer of high-impact, cost effective packaging, displays and signage solutions. From May 2010 through November 2012 Mr. Keough was a principal in the Keough Group, LLC, a consulting firm. From January 2005 through May 2010 Mr. Keough was President and Chief Executive Officer of Caraustar Industries, a manufacturer of paperboard and paperboard products, and from March 2002 to December 2004, he served as Senior Vice President and Chief Operating Officer of Caraustar Industries. Prior to Caraustar Industries, Mr. Keough worked for 16 years at Gaylord Container Corporation where he held various positions, ultimately serving as President and Chief Operating Officer.

Mr. Keough brings broad operating experience to the Board of Directors developed over 40 years in manufacturing. His experience provides valuable insights into a wide variety of operational and management issues we may face.

|

| | |

| Chantal D. Veevaete | Age 61 | Class I |

Ms. Veevaete has been a member of our Board of Directors since March 2016. From May 2012 through December 2014, Ms. Veevaete served as Senior Vice President, Human Resources of Phillips 66, a diversified energy and logistics company, and prior to that she served as Designated Leader, Human Resources with ConocoPhillips, where she helped implement the separation of Phillips 66 from ConocoPhillips. From April 2009 through January 2012, Ms. Veevaete served as Vice President, Human Resources of Chevron Phillips Chemical, a chemical producer jointly owned by Chevron and Phillips 66. From August 2005 through February 2009, Ms. Veevaete served as Vice President, Human Resources of Medco Health Solutions (Accredo Health Division).

Ms. Veevaete brings a significant level of expertise in human resources, talent management and succession planning to the Board developed over more than 25 years in business. Her expertise provides valuable insights to the board on these matters, as well as insights into day-to-day operational management of the business.

|

| | |

| James Bachmann | Age 50 | Class II |

Mr. Bachmann has served as our President and Chief Executive Officer since January 2015 and has been a member of our Board of Directors since March 2015. Mr. Bachmann served as our Chief Financial Officer from January 2014 to May 2015 and also briefly served as our interim Chief Executive Officer from November 2014 to January 2015. Prior to becoming our Chief Financial Officer in January 2014, Mr. Bachmann served as Chief Financial Officer of Lafarge USA and co-Chief Financial Officer of Lafarge North America Inc., or Lafarge, from November 2012 through December 31, 2013. He served as Senior Vice President Finance - Investor Relations of Lafarge S.A. from January 2008 through October 2012, Senior Vice President and Controller of Lafarge from November 2005 to June 2006, Vice President Finance - Aggregates, Concrete, and Asphalt Division of Lafarge from February 2004 to November 2005, Vice President Controller of the Gypsum Division of Lafarge from May 2002 to February 2004, and worked at Arthur Andersen from September 1990 to April 2002. Mr. Bachmann received a BSBA from Georgetown University.

As our President and Chief Executive Officer, Mr. Bachmann brings a deep understanding of our business, industry, operations, and strategic planning to the Board. Mr. Bachmann also has extensive institutional knowledge gained through his more than 11 years of experience with Lafarge and Lafarge SA. Mr. Bachmann’s service also provides a direct and open channel of communication between the Board and senior management.

|

| | |

| Ira S. Strassberg | Age 52 | Class II |

Mr. Strassberg has been a member of our Board of Directors since March 2017. Since January 2018, Mr. Strassberg has served as Deputy Chief Financial Officer for Cantor Fitzgerald, a global financial services firm, and he has served as Chief Financial Officer for Cantor Commercial Real Estate Company L.P. (CCRE), a commercial real estate finance firm, since 2014. He has served as Executive Treasurer since January 2018, and as Chief Financial Officer from 2012 through January 2018, for Newmark Knight Frank Multifamily Capital Markets (formerly known as Berkeley Point Capital LLC,) a commercial real estate finance firm specializing in multifamily housing. From 2008 to 2012 Mr. Strassberg served as Senior Vice President and Multifamily Chief Financial Officer for Fannie Mae. From 2006 to 2008 Mr. Strassberg served as Chief Financial Officer for Walker & Dunlop, a commercial real estate financial services provider.

Mr. Strassberg brings a significant level of financial and accounting expertise to the Board, particularly focused on the real estate and financial services industries. His public company experience and deep knowledge of real estate finance provide valuable insight into the reporting requirements faced by public companies in the Company's sector.

|

| | |

| Edward Bosowski | Age 64 | Class III |

Mr. Bosowski has been a member of our Board of Directors since February 2014 and began serving as Chairman of the Board in March 2016. Mr. Bosowski worked for USG Corporation (USG), the largest manufacturer of gypsum wallboard in the United States, for over 30 years. His final position at USG was Executive Vice President, Chief Strategy Officer, and President and CEO of USG's international subsidiary, positions he held from 2006 to 2008. From 2001 to 2006, his responsibilities included being a member of the Office of the President for USG Corporation and several direct reporting relationships, including USG's distribution subsidiary, its international subsidiary and various staff functions. From 1996 to 2001, he served as Executive Vice President of Sales and Marketing for the domestic gypsum business and became President and CEO of the North American Gypsum Business Unit. After joining USG in 1976, Mr. Bosowski held various positions and leadership roles in several operations and staff functions, including finance, marketing, supply chain, information technology, research and development, engineering, technical services, and business development.

Mr. Bosowski brings a significant level of industry experience to the Board, developed during his more than 30 years in the gypsum industry. His extensive expertise and broad leadership roles in the North American gypsum industry provide valuable insight and guidance.

|

| | |

| Michael O. Moore | Age 68 | Class III |

Mr. Moore has been a member of our Board of Directors since February 2014. Mr. Moore is the Chief Operating Officer of Tervis Tumbler Company, a manufacturer of drinkware, a position he has held since August 2017. Mr. Moore served as Chief Financial Officer of Forman Mills, a retail chain and department store, from October 2016 to August 2017. Until August 2014, Mr. Moore served as Executive Vice President, Chief Financial Officer and Assistant Secretary of Ruby Tuesday, Inc., a national owner, operator or franchisor of casual dining restaurants, a position he held since April 2012. Prior to joining Ruby Tuesday, Mr. Moore was employed with Sun Capital Partners as Executive Vice President and Chief Financial Officer of Pamida Stores from February 2009 to March 2012 and as Interim Chief Financial Officer of Kellwood, Inc. from November 2008 to February 2009. Prior to his tenure with Sun Capital Partners, Mr. Moore served as Executive Vice President and Chief Financial Officer of Advanced Auto Parts from December 2005 to February 2008. Additionally, prior to December 2005, among other positions, Mr. Moore served as Executive Vice President and Chief Financial Officer of The Cato Corporation and as Senior Vice President and Chief Financial Officer of Bloomingdales.

Mr. Moore brings a significant level of financial and accounting expertise to the Board developed during his more than 30-year career. Mr. Moore's wealth of public company experience provides valuable insight regarding public company reporting matters, as well as insight into management’s day-to-day duties and responsibilities.

|

| | |

| Jack Sweeny | Age 72 | Class III |

Mr. Sweeny has been a member of our Board of Directors since February 2014. Mr. Sweeny worked for Temple-Inland, Inc., a leading building products company, for 40 years. His final position at Temple-Inland was Group Vice President of Temple-Inland, a position he held from 2002 to 2010. Prior to becoming Group Vice President, Mr. Sweeny served as Vice President of Forest Operations from 1995 to 2002 and as Vice President of Operations from 1984 to 1995. After joining Temple-Inland in 1970, Mr. Sweeny held various positions and leadership roles at the company, including managing its marketing department.

Mr. Sweeny brings broad industry expertise to the Board of Directors developed during his 40 years in the building products industry, including experience with all aspects of the gypsum wallboard manufacturing process. His experience provides valuable insight and guidance to the Board on the building products industry as a whole.

Director Skills and Experience

The following matrix shows the most significant skills and qualifications that each director possesses.

|

| | | | |

Name and Experience | | Age | | Class |

James Bachmann -Mr. Bachmann has served as our President and Chief Executive Officer since January 2015 and has been a member of our Board of Directors since March 2015. Mr. Bachmann served as our Chief Financial Officer from January 2014 to May 2015 and also briefly served as our interim Chief Executive Officer from November 2014 to January 2015. Prior to becoming our Chief Financial Officer in January 2014, Mr. Bachmann served as Chief Financial Officer of Lafarge USA and co-Chief Financial Officer of Lafarge North America Inc., or Lafarge, from November 2012 through December 31, 2013. He served as Senior Vice President Finance - Investor Relations of Lafarge S.A. from January 2008 through October 2012, Senior Vice President and Controller of Lafarge from November 2005 to June 2006, Vice President Finance - Aggregates, Concrete, and Asphalt Division of Lafarge from February 2004 to November 2005, Vice President Controller of the Gypsum Division of Lafarge from May 2002 to February 2004, and worked at Arthur Andersen from September 1990 to April 2002. Mr. Bachmann received a BSBA from Georgetown University.

As our President and Chief Executive Officer, Mr. Bachmann brings a deep understanding of our business, industry, operations, and strategic planning to the Board. Mr. Bachmann also has extensive institutional knowledge gained through his more than 11 years of experience with Lafarge and Lafarge SA. Mr. Bachmann’s service also provides a direct and open channel of communication between the Board and senior management.

| | 47 | | II |

Continuing Directors

|

| | | | |

Name | Senior Executive | Operations | Finance | Sales and ExperienceMarketing | Gypsum/Paper Industry | Human Resources |

| James Bachmann | ü | ü | ü | ü | ü | ü |

| Ed Bosowski | ü | ü | ü | ü | ü | |

| Mike Keough | ü | ü | | Ageü | ü | |

| Michael Moore | ü | ü | ü | | Class | ü |

Edward Bosowski-Mr. Bosowski has been a member of our Board of Directors since February 2014 and began serving as Chairman of the Board in March 2016. Mr. Bosowski worked for USG Corporation (USG), the largest manufacturer and distributor of gypsum wallboard in the United States, for over 30 years. His final position at USG was Executive Vice President, Chief Strategy Officer, and President and CEO of USG’s international subsidiary, positions he held from 2006 to 2008. From 2001 to 2006, his responsibilities included being a member of the Office of the President for USG Corporation and several direct reporting relationships, including USG’s distribution subsidiary, its international subsidiary and various staff functions. From 1996 to 2001, he served as Executive Vice President of Sales and Marketing for the domestic gypsum business and became President and CEO of the North American Gypsum Business Unit. After joining USG in 1976, Mr. Bosowski held various positions and leadership roles in several operations and staff functions, including finance, marketing, supply chain, information technology, research and development, engineering, technical services, and business development.

Mr. Bosowski brings a significant level of industry experience to the Board, developed during his more than 30 years in the gypsum industry. His extensive expertise and broad leadership roles in the North American gypsum industry provide valuable insight and guidance.

Ira Strassberg | ü | | 61ü | | III |

|

| Jack Sweeny | ü | | | |

Michael J. Keough-Mr. Keough has been a member of our Board of Directors since March 2016. Since November 2012, Mr. Keough has served as President and Chief Executive Officer of Stronghaven Inc., a manufacturer of high-impact, cost effective packaging, displays and signage solutions since December 2013. From May 2010 through November 2012 Mr. Keough was a principal in the Keough Group, LLC, a consulting firm. From January 2005 through May 2010 Mr. Keough was President and Chief Executive Officer of Caraustar Industries, a manufacturer of paperboard and paperboard products, and from March 2002 to December 2004, he served as Senior Vice President and Chief Operating Officer of Caraustar Industries. Prior to Caraustar Industries, Mr. Keough worked for 16 years at Gaylord Container Corporation where he held various positions, ultimately serving as President and Chief Operating Officer.

Mr. Keough brings broad operating experience to the Board of Directors developed over 40 years in industry. His experience provides valuable insights into a wide variety of operational and management issues we may face.

ü | | 65ü | ü | |

| Chantal Veevaete | ü | | I |

Michael O. Moore-Mr. Moore has been a member of our Board of Directors since February 2014. Until August 2014, Mr. Moore served as Executive Vice President, Chief Financial Officer and Assistant Secretary of Ruby Tuesday, Inc., a national owner, operator or franchisor of casual dining restaurants, a position he held since April 2012. Prior to joining Ruby Tuesday, Mr. Moore was employed with Sun Capital Partners as Executive Vice President and Chief Financial Officer of Pamida Stores from February 2009 to March 2012 and as Interim Chief Financial Officer of Kellwood, Inc. from November 2008 to February 2009. Prior to his tenure with Sun Capital Partners, Mr. Moore served as Executive Vice President and Chief Financial Officer of Advanced Auto Parts from December 2005 to February 2008. Additionally, prior to December 2005, among other positions, Mr. Moore served as Executive Vice President and Chief Financial Officer of The Cato Corporation and as Senior Vice President and Chief Financial Officer of Bloomingdales.

Mr. Moore brings a significant level of financial and accounting expertise to the Board developed during his more than 30 year career. Mr. Moore’s wealth of public company experience provides valuable insight regarding public company reporting matters, as well as insight into management’s day-to-day duties and responsibilities.

| | 65 | | III |

Jack Sweeny-Mr. Sweeny has been a member of our Board of Directors since February 2014. Mr. Sweeny worked for Temple-Inland, Inc., a leading building products company, for 40 years. His final position at Temple-Inland was Group Vice President of Temple-Inland, a position he held from 2002 to 2010. Prior to becoming Group Vice President, Mr. Sweeny served as Vice President of Forest Operations from 1995 to 2002 and as Vice President of Operations from 1984 to 1995. After joining Temple-Inland in 1970, Mr. Sweeny held various positions and leadership roles at the company, including managing its marketing department. Mr. Sweeny is a member of the board of directors of First Bank & Trust East Texas.

Mr. Sweeny brings broad industry expertise to the Board of Directors developed during his 40 years in the building products industry, including experience with all aspects of the gypsum wallboard manufacturing process. His experience provides valuable insight and guidance to the Board on the building products industry as a whole.

| | 69 | | III |

Chantal D. Veevaete-Ms. Veevaete has been a member of our Board of Directors since March 2016. From May 2012 through December 2014, Ms. Veevaete served as Senior Vice President, Human Resources of Phillips 66, a diversified energy and logistics company, and prior to that she served as Designated Leader, Human Resources with ConocoPhillips, where she helped implement the separation of Phillips 66 from ConocoPhillips. From April 2009 through January 2012, Ms. Veevaete served as Vice President, Human Resources of Chevron Phillips Chemical, a chemical producer jointly owned by Chevron and Phillips 66. From August 2005 through February 2009, Ms. Veevaete served as Vice President, Human Resources of Medco Health Solutions (Accredo Health Division).

Ms. Veevaete brings a significant level of expertise in human resources, talent management and succession planning to the Board developed over more than 25 years in business. Her expertise provides valuable insights to the board on these matters, as well as insights into day-to-day operational management of the business.

| | 58 | | Iü |

Meetings of the Board of Directors

The Board of Directors holds regularly scheduled meetings throughout the year and holds additional meetings from time to time as the Board of Directors deems necessary or desirable to carry out its responsibilities. The Board of Directors held five11 meetings in fiscal 2015.2018. All directors attended at least 75% of all meetings of the Board of Directors and of the committees thereof on which they served during the year. The Board of Directors has a policy that directors are expectedencouraged to attend the annual meetings of stockholders. NoneAll of theour directors attended the 20152018 annual meeting of stockholders.

Director Compensation

EachAs set forth in its charter, the Compensation Committee is responsible for reviewing the compensation of our non-employee directors and recommending any changes in such compensation to the Board as appropriate. In accordance with this authority, the Compensation Committee has engaged an independent compensation consultant, Aon, to provide advice on matters related to director compensation.

For 2018, each of our non-employee directors receivesreceived an annual cash retainer of $50,000, per year, except that anyour non-executive chairman of the board receivesreceived an annual cash retainer of $75,000 per year. Until January 1, 2016,$112,500. Our non-employee directors received an additional $2,500 annual fee for service as the chairman of the board or as chairperson of a committee of the Board, other than the chair of the Audit Committee, whoalso received an annual fee of $5,000. Effective January 1, 2016, we increased the annual fee payable for service as chairperson of a committee to $8,000 and the annual fee payable to the chair of the Audit Committee to $12,500. Effective January 1, 2016, we began paying our independent directors an annual fee of $5,000$7,000 for service as a member of a committee, other than the Audit Committee, whosethe members receiveof which received an annual fee of $7,500. Independent$10,000. The chair of the Audit Committee received an additional $15,000 annual fee, the chair of the Compensation Committee received an additional $12,000 annual fee, and the chair of the Nominating and Corporate Governance Committee received an additional $10,000 annual fee, for service as chairperson of each such committee of the Board. Cash fees are paid quarterly in arrears. Non-employee directors also received an annual equity grant, with a target value of $43,200 for 2015,$75,000. These annual equity grants are made in the form of restricted stock units, which amount was increasedvest on the first anniversary of the grant date. The Company does not provide pensions, medical benefits or other benefit programs to $57,000 for 2016. Cash fees are paid quarterly in arrears.non-employee directors. Directors who are also members of management or who were affiliated with Lone Star are not separately compensated for their services as a director. Until January 1, 2016, independent directors received meeting attendance fees of $1,500 for each meeting of the Board of Directors or a Committee attended. Effective January 1, 2016 attendance fees were no longer paid.

The table below sets forth the compensation paid (or credited) toearned by each of the Company’s non-management directors during 2015:

2018:

| | | Name | Fees earned or paid in cash ($) | Stock awards ($)(1) | Total ($) | Fees earned or paid in cash ($) | Stock awards ($)(1) | Total ($) |

| Edward Bosowski | 72,250 | 53,244 | 125,494 | 126,500 | 71,550 | 198,050 |

| Michael Keough | | 67,000 | 71,550 | 138,550 |

| Michael O. Moore | 73,000 | 53,244 | 125,494 | 72,000 | 71,550 | 143,550 |

| Ira Strassberg | | 60,000 | 71,550 | 131,550 |

| Jack Sweeny | 67,750 | 53,244 | 125,494 | 70,000 | 71,550 | 141,550 |

| Chantal Veevaete | | 69,000 | 71,550 | 140,550 |

| |

| (1) | Represents the aggregate grant date fair value of restricted stock unit, or RSU, awards granted on March 2, 2015February 21, 2018 under theour Amended and Restated 2014 Stock Incentive PlanPlan. These values are calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Stock Compensation,, or ASC 718. As718, based on the closing price of December 31, 2015, Mr. Sweeny held an aggregate of 3,153 unvested shares of restrictedour common stock and RSUs and 2,500 stock options (1,250 of which were exercisable) and Messrs. Bosowski and Moore each held an aggregate of 3,152 unvested shares of restricted stock and RSUs and 2,500 stock options (1,250 of which were exercisable). on the grant dates. |

Controlled Company ExemptionAs of December 31, 2018, Messrs. Bosowski, Keough, Moore, Strassberg and Sweeny and Ms. Veevaete each held an aggregate of 2,650 unvested RSUs. In addition, as of that date, Messrs. Bosowski, Moore and Sweeny each held 2,500 stock options (all of which were exercisable).

Because Lone Star previously controlled more than 50%2019 Director Compensation Program

In November of 2018, our common stock, we were a “controlled company” withinCompensation Committee reviewed our non-employee director compensation program. In conducting this review, the meaningCompensation Committee, in consultation with Aon, compared our director compensation program to the same industry peer group discussed in further detail below under "Compensation Discussion and Analysis - General Industry Peer Group." Based on the information provided by Aon, our Compensation Committee determined that our non-employee directors' total annual compensation (consisting of cash and equity-based compensation) was between the 25th and 50th percentile of the corporate governance standardsCompany's peer group. Because the non-employee director compensation for the Company was considered to be consistent with the Company's annual revenue size compared to its peer group, in accordance with our compensation philosophy, the Compensation Committee recommended and the Board approved the decision to make no changes to the 2019 non-employee director compensation program.

Director Independence

Pursuant to the Company's Principles of theCorporate Governance and New York Stock Exchange or NYSE. Accordingly, we previously availed ourselves of the “controlled company” exception available under the NYSE rules which eliminated certain requirements, such as the requirements that a company have a majority of independent directors on its board of directors, that compensation of the executive officers be determined, or recommended to the board of directors for determination, byRules, a majority of the independent directors or a compensation committee comprised solelyBoard of independent directors, and that director nominees be selected, or recommended for the board of directors’ selection, by a majority of the independent directors or a nominations committee comprised solelyDirectors shall consist of independent directors. AsCurrently, all members of March 18, 2015, Lone Star no longer beneficially owned morethe Board of Directors are independent, other than 50% ofMr. James Bachmann, our common stockPresident and we ceased to be a controlled company eligible to utilize the exemptions described above. We complied with all applicable transition rules within the relevant time periods in respect of losing our controlled company status and are now in full compliance with the NYSE corporate governance standards.

Director Independence

Chief Executive Officer. The Board of Directors has affirmatively determined that each of Messrs. Bosowski, Keough, Moore, Strassberg and Sweeny and Ms. Veevaete is independent under the NYSE rules. The NYSE’s definition of independence includes a series of objective tests, such as that the director is not an employee of the Company and has not engaged in various types of business dealings involving the Company, which would prevent a director from being independent.

Board Leadership Structure

The Company’sCompany's Principles of Corporate Governance provide that the Board shall periodically evaluate and make a determination regarding whether or not to separate the roles of Chairman and Chief Executive Officer based upon the circumstances. Currently, the roles are separate and the Board is led by a non-executivean independent Chairman, Mr. Bosowski. The Board has determined, at this time, that having a non-executivean independent Chairman provides significant advantages to the Board, as it allows our Chief Executive Officer to focus on the Company’sCompany's day-to-day operations, while allowing the Chairman to lead our Board of Directors in its role of providing oversight and advice to management. The Principles of Corporate Governance, however, provide us with the flexibility to combine these roles in the future, permitting the roles of Chief Executive Officer and Chairman to be filled by the same individual. This provides our Board of Directors with flexibility to determine whether the two roles should be combined in the future based on our company’scompany's needs and our Board of Directors’Directors' assessment of our leadership structure from time to time.

In addition, pursuant to the Company’s Principles of Corporate Governance, the independent directors may appoint an independent director to serve as the lead independent director for a period of time as determined by the independent directors as a group. The lead independent director’s responsibilities will include such responsibilities delegated thereto by the Board, and may also include: presiding at meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors; approving information sent to the Board; approving the agenda and schedule for Board meetings to provide that there is sufficient time for discussion of all agenda items; serving as liaison between the Chairman and the independent directors; and being available for consultation and communication with major stockholders upon request. Any lead independent director shall have the authority to call executive sessions of the independent directors. If the Chairman of the Board is an independent director, he or she shall act as the lead independent director.

The Board’sBoard's Role in Risk Oversight

The Board of Directors oversees the Company’sCompany's risk management process. The Board oversees a Company-wide approach to risk management, designed to enhance stockholder value, support the achievement of strategic objectives and improve long-term organizational performance. The Board determines the appropriate level of risk for the Company generally, assesses the specific risks faced by the Company and reviews the steps taken by management to manage those risks. The Board’sBoard's involvement in setting the Company’sCompany's business strategy facilitates these assessments and reviews, culminating in the development of a strategy that reflects both the Board’sBoard's and management’smanagement's consensus as to appropriate levels of risk and the appropriate measures to manage those risks. Pursuant to this structure, risk is assessed throughout the enterprise, focusing on risks arising out of various aspects of the Company’sCompany's strategy and the implementation of that strategy, including financial, legal/compliance, operational/operational, strategic, health and safety, and compensation risks. The Board also considers risk when evaluating proposed transactions and other matters presented to the Board, including acquisitions and financial matters.

While the Board maintains the ultimate oversight responsibility for the risk management process, its committees oversee risk in certain specified areas. In particular, the Audit Committee reviews and discusses the Company’sCompany's practices with respect to risk assessment and risk management. The Audit Committee also focuses on financial risk, including internal controls and cybersecurity, and discusses the Company’sCompany's risk profile with the Company’sCompany's independent registered public accounting firm. In addition, the Audit Committee oversees the Company’sCompany's compliance program with respect to legal and regulatory requirements, including the Company’s codesCompany's Code of conductEthics and Business Conduct and policies and procedures for monitoring compliance. The Compensation Committee periodically reviews compensation practices and policies to determine whether they encourage excessive risk taking, including an annual review of management’smanagement's assessment of the risk associated with the Company’sCompany's compensation programs covering its employees, including executives, and discusses the concept of risk as it relates to the Company’sCompany's compensation programs. Finally, the Nominating and Corporate Governance Committee managesoversees risks associated with the independence of directors and Board nominees.nominees and the Company's corporate governance. Management regularly reports on applicable risks to the relevant committee or the Board, as appropriate, including reports on significant Company projects, with additional review or reporting on risks being conducted as needed or as requested by the Board and its committees.

Succession Planning and Leadership Development